Unique Strategies - Deep Due Diligence

Simulations inspired by military war-games... Moving beyond static analysis to actively simulate scenarios and test assumptions with AI can indeed yield much richer insights, forcing participants to confront potential realities rather than just theorize.

Here's a list of creative ways to use LLM chats to "war game" their insights, projections, and assumptions for a startup during the due diligence and the formulation of a bullet-proof investment thesis:

Creative AI Simulation & Testing Techniques("War Gaming" for Due Diligence)

Go beyond static best/worst/base cases. Test how core strategies hold up against specific persona reactions.

Define a key strategic plank or milestone from the Curen analysis (e.g., achieving €50/MWh LCOS, securing first utility pilot). Then, prompt different LLM personas (Skeptic, Competitor, Target Customer) to react specifically to that plank.

Forces students to anticipate specific objections and prepare data-driven counterarguments or adjust their assumptions.

Anticipate and evaluate the impact of competitor actions beyond just listing them.

Propose a specific successful action by Curen (e.g., announcing a major funding round, landing a key partnership). Prompt an LLM acting as a specific competitor (using info gathered via Perplexity/Search) to outline their likely strategic response.

Helps assess the resilience of Curen's competitive advantage and highlights potential market dynamics.

Test product-market fit and sales strategy assumptions against realistic customer pushback.

Develop detailed target customer personas (e.g., Utility Procurement Manager, Renewable Project Developer). Have the LLM embody that persona and conduct a simulated sales meeting or Q&A session where the student pitches Curen.

Uncovers weaknesses in the value proposition or GTM strategy, identifies key evidence needed for customer adoption.

Stress-test financial projections against pessimistic or unexpected internal/external factors.

Instruct an LLM (acting as a "Pessimistic CFO" or "External Shock Simulator") to critique key financial assumptions (sales growth, COGS reduction, OpEx) or introduce specific negative scenarios (e.g., funding delays, input cost spikes, slower adoption). Use LLMs capable of calculation (like GPT-4o/Gemini Advanced) to explore the quantitative impact of these changes.

Highlights financial vulnerabilities, quantifies risks, and informs contingency planning/funding strategy.

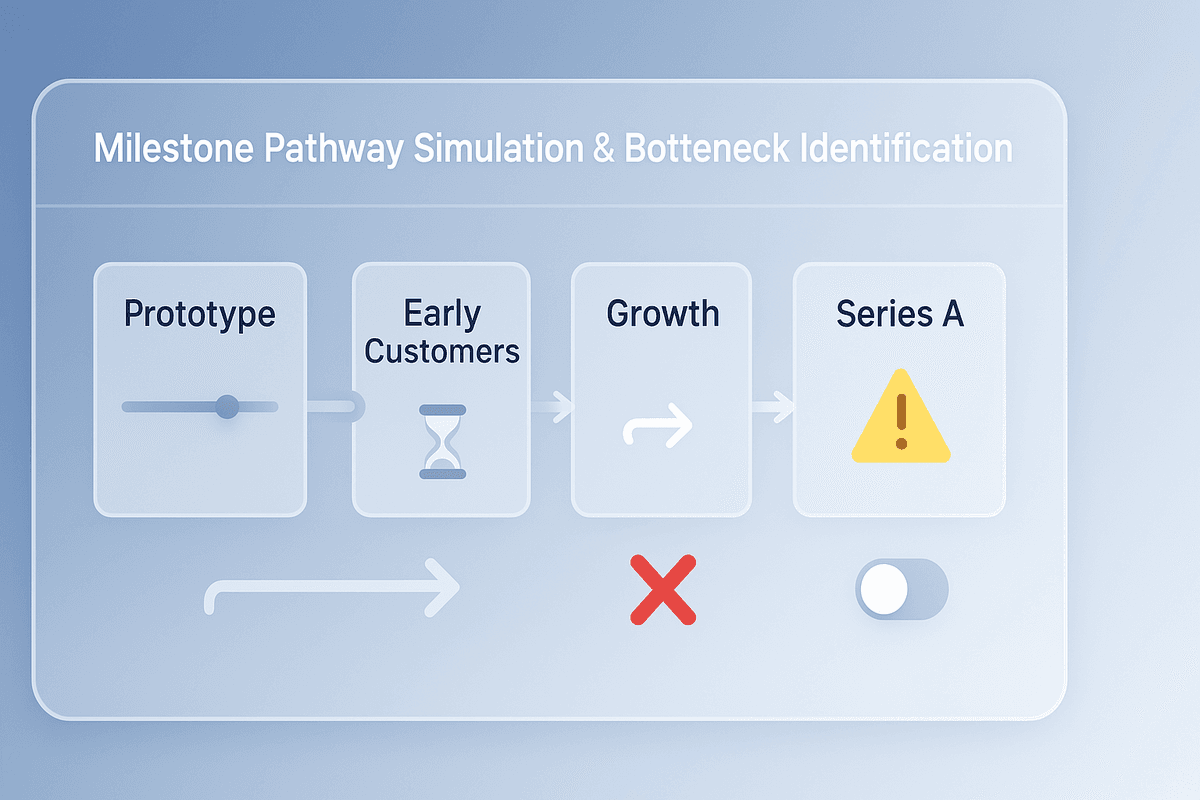

Test the feasibility and interdependencies of the proposed milestones.

Input Curen's key milestones (technical, commercial, funding). Ask the LLM to identify potential bottlenecks, resource conflicts, or critical path dependencies. Simulate the ripple effect of a delay in one key milestone.

Improves the realism of the roadmap, identifies critical areas needing de-risking, helps prioritize resources.

Test the assumptions behind international expansion or partnership strategies.

Building on the user's "Cross-Cultural Tester," simulate specific interactions like negotiations or market entry planning with an LLM acting as a stakeholder from the target culture.

Uncovers potential friction points, informs negotiation strategy, and highlights the need for cultural adaptation in GTM plans.

Tools for Simulation

- LLMs (Gemini/GPT-4o):Essential for persona embodiment, complex scenario generation, reacting to inputs, simulating dialogue, and performing basic calculations/sensitivity analysis within the simulation.

- Perplexity/Search:Useful for gathering background information to make the personas and scenarios more realistic (e.g., details about competitors, market trends, cultural business norms).

- Spreadsheet Software (Human driven, AI assisted):While AI can red team assumptions, the core financial model building often still happens here. AI can help generate formulas or analyze outputs.